Post Insurance decision support

The AI-GILE framework uses the toolbox of machine learning and historical data to support decision-making in the areas of tariff calculation, attrition and claims settlement with reports and suggestions.

Platforms

.Net Win WebTechnologies

C# R WPF MSSQL Access SQLite Docker REST

The framework developed for the Hungarian Post Insurance Ltd. utilizes the tools for machine learning to produce reports that aid in the operative - or even strategic - decision-making. The system, which was named AI-GILE, uses anonymized, historic data, to give suggestions on matters such as tariff calculation, attrition, or claims settlement. The answers to the relevant questions are sought by multiple configurable, supervised and unsupervised machine learning models and their combinations.

Complex system

This is an R+D project, so the formation of an analytic framework and the execution of the analysis is an equally important part of the project as the development of the tool. The first version of the system was finished in 2019 and since then, during a multiple year agile development process, the performance has been enhanced and the system has been expanded with many new functions.

AI-GILE is made up of a data processing and analyzing desktop client application and a server from which the results can be queried. The program was written in C# in .NET framework, however the data processing core and the machine learning functions were completed in R. The original version of the program utilized an internally developed C# wrapper, that ran the R code and transferred the data. The current solution though is installed in a docker container that starts with the client application and calls the R server’s end points through REST API.

Machine learning

The project’s R+D nature necessitated the review of numerous configurations of hyperparameters in the applied machine learning models. The application uses various graphical interfaces to support the creation of these configurations. AI-GILE enables the generation of new variables based on previous ones, the regrouping of categorical variables, and the filtering of outlier values. The selection of the suitable values is assisted by the real time display of descriptive statistical indicators, graphs and parameterizable algorithms, such as variable selection or outlier border identification.

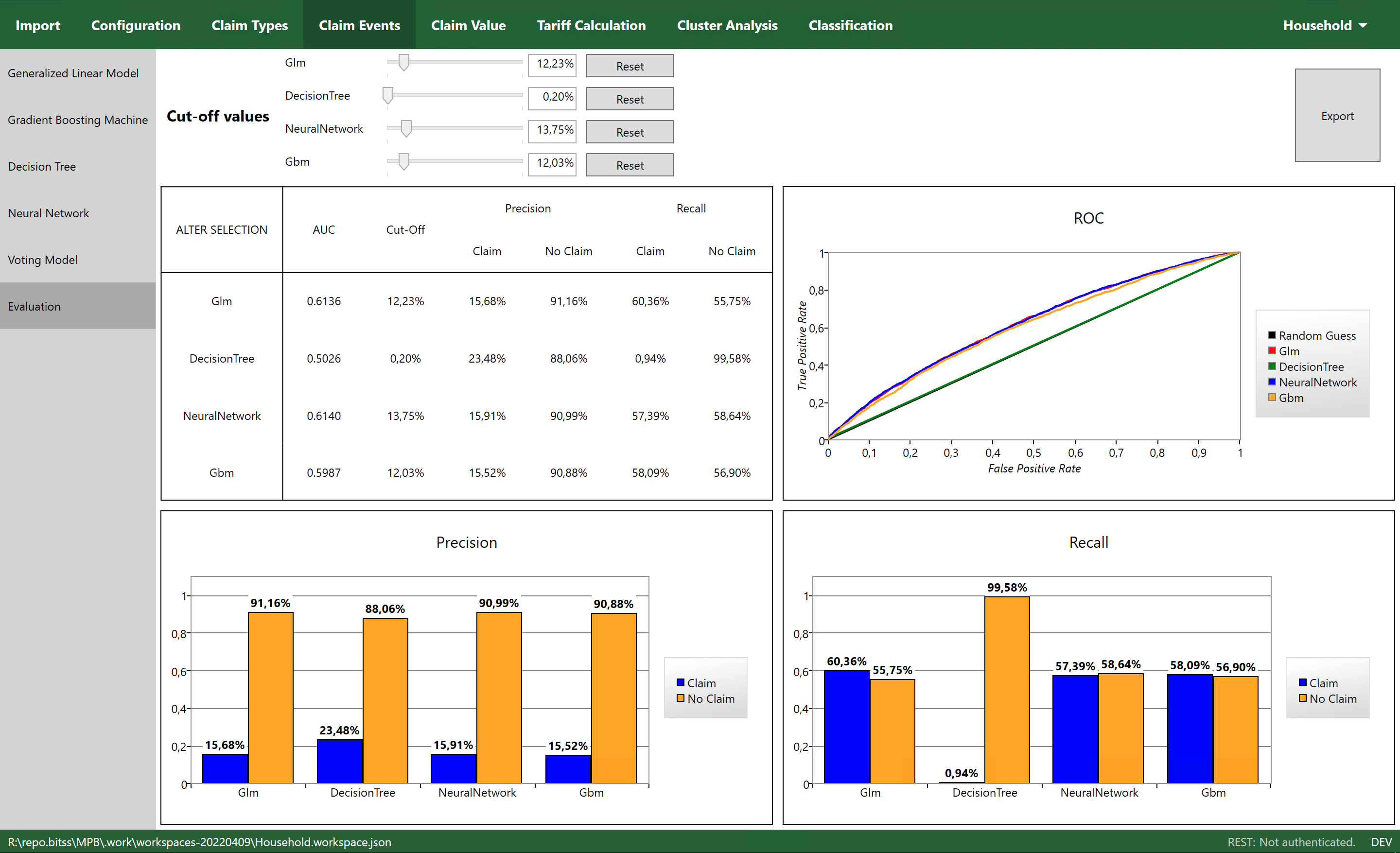

The system primarily facilitates the prediction of the probability of damages happening and their extent, with the application of diverse machine learning solutions. Besides simple linear regression, the system can also be taught by gradient boosting, random forest, and deep learning neural networks. However, based on experience, the best results are achieved by using the weighted arithmetic mean of the output of the various models in a voting model. The system supports the evaluation of the models with multiple tools, and the exploration of the most effective configurations for the business interests.

Professional experience

The development of the analytical framework is the result of the cooperation between the Hungarian Post Insurance Ltd.’s actuaries and the Bits Studio group. From the latter, a certified insurance and financial mathematician-economist and a business informatics PhD graduate contributed. From the collaboration a research paper was also written about the modelling of MTPL insurance claim events.